The Middle Way Society was founded to promote the study and practice of The Middle Way. The Middle Way is the idea that we make better judgements by avoiding fixed beliefs and being open to practical experience. We challenge unhelpful distinctions between facts and values, reason and emotion, religion and secularism or arts and sciences. Though our name is inspired by some of the insights of the Buddha, we are independent of Buddhism or any other religion. We seek to promote and support integrative practice, overcoming conflict of all kinds.

What is the universal Middle Way? Find out more with our introductory video series

Join the Middle Way Network for Zoom talks and discussions to explore the Middle Way and its practice

Come for a face-to-face retreat at Tirylan House in Wales to combine discussion of the Middle Way, practice, and friendship

Browse and listen to the Middle Way Society podcasts, connecting the Middle Way to a wide range of interests

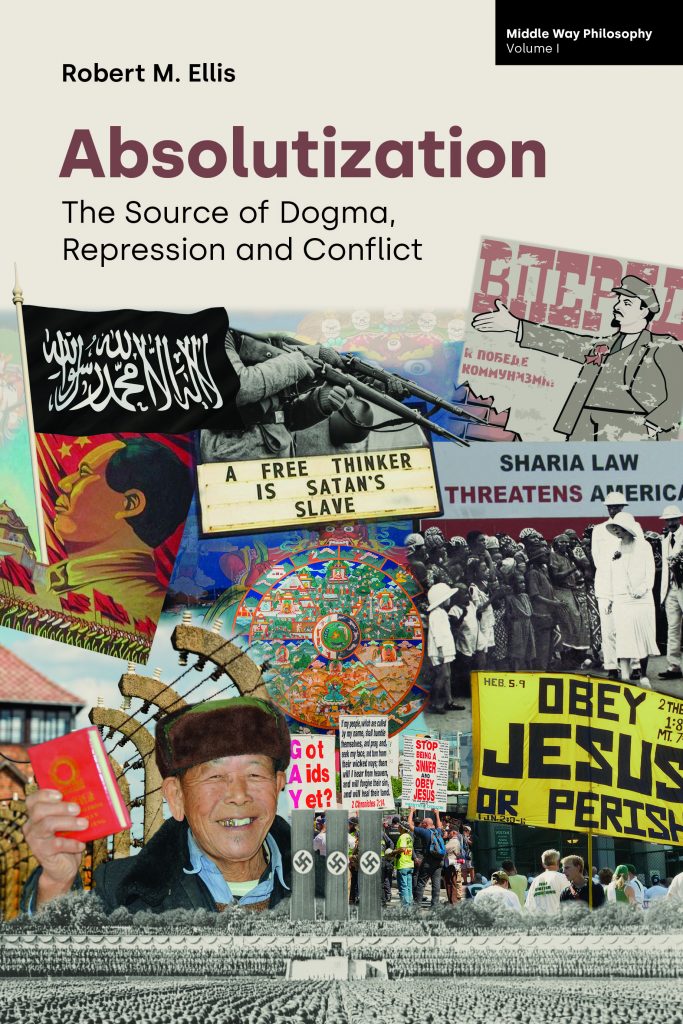

Explore Robert M. Ellis’s books about Middle Way Philosophy

(link connects to Robert’s author website)

Join our Facebook discussion group

(link connects to Facebook)

Read the latest blogs and reviews on this website

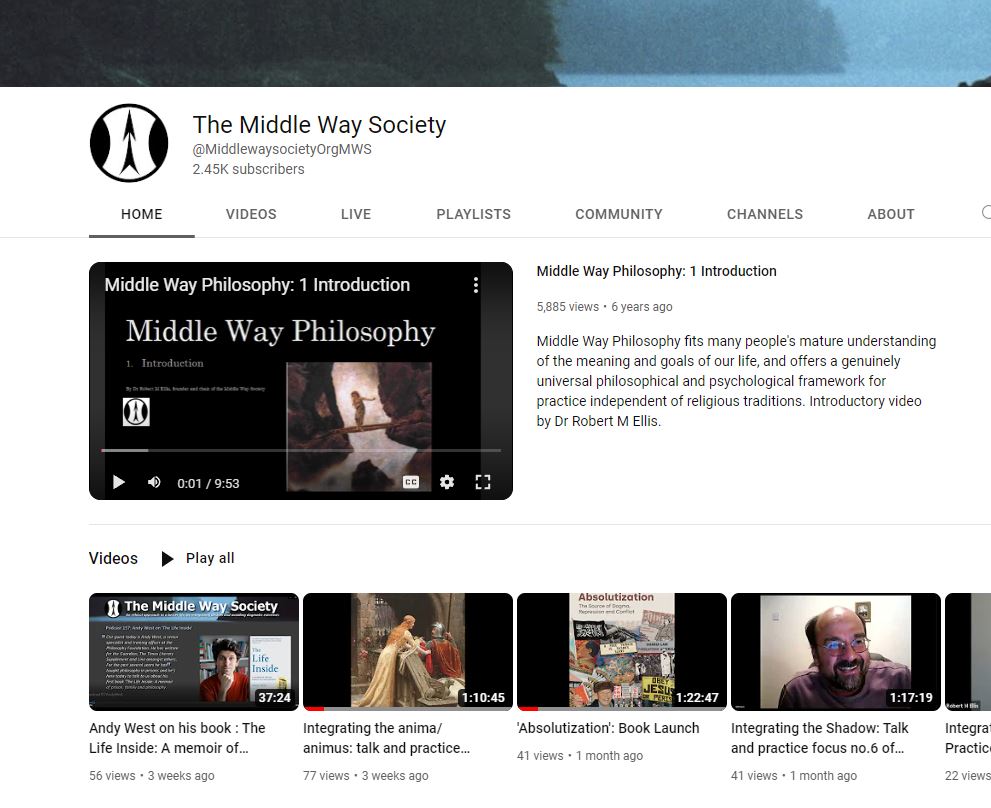

See the latest recorded talks and podcasts on our Youtube channel

(link connects to Youtube)